5 Reasons to Move Your Crypto Off Exchanges

#1: HACKS & HEISTS

The Dark Reality of Crypto Exchange Hacks

Since Bitcoin’s early days, centralized exchanges have been prime targets for hackers seeking massive payouts. From the infamous Mt. Gox hack in 2014, where attackers stole ~850,000 BTC worth billions today, to the Coincheck breach in 2018 where $530 million in NEM tokens vanished overnight, these heists exposed the vulnerability of custodial platforms. In 2016, Bitfinex lost ~120,000 BTC due to a multi-signature security exploit, and even “secure” giants like Binance faced a $40 million hack in 2019 involving advanced phishing and API vulnerabilities. Attackers use ransomware, social engineering, insider corruption, and direct code exploits to drain user funds with little chance of recovery. These breaches happen because exchanges remain online and connected at all times, creating an open door for cybercriminals. In contrast, cold wallets stay offline, making them immune to online hacks and ensuring your crypto stays in your control and out of reach from attackers.

#2: BANKRUPTCIES

When Exchanges Collapse Overnight

Crypto history is filled with exchanges collapsing under financial mismanagement, fraud, or regulatory crackdowns, leaving customers with no way to recover their funds. In 2014, Mt. Gox filed for bankruptcy after losing customer Bitcoin to hacks and internal failures. More recently, FTX imploded in 2022, revealing an $8 billion hole in its balance sheet and locking out millions of users overnight. Platforms like Celsius, Voyager, and BlockFi also filed for bankruptcy in 2022, freezing withdrawals as liquidity dried up. These bankruptcies show that no matter how large or trusted an exchange may appear, they are ultimately companies with balance sheets, debts, and legal obligations that can instantly jeopardize your assets. Cold wallets protect you from these risks because your funds are kept offline, in your own hands, with no dependency on whether an exchange stays in business.

#3: HALTED WITHDRAWALS

Locked Out Without Warning

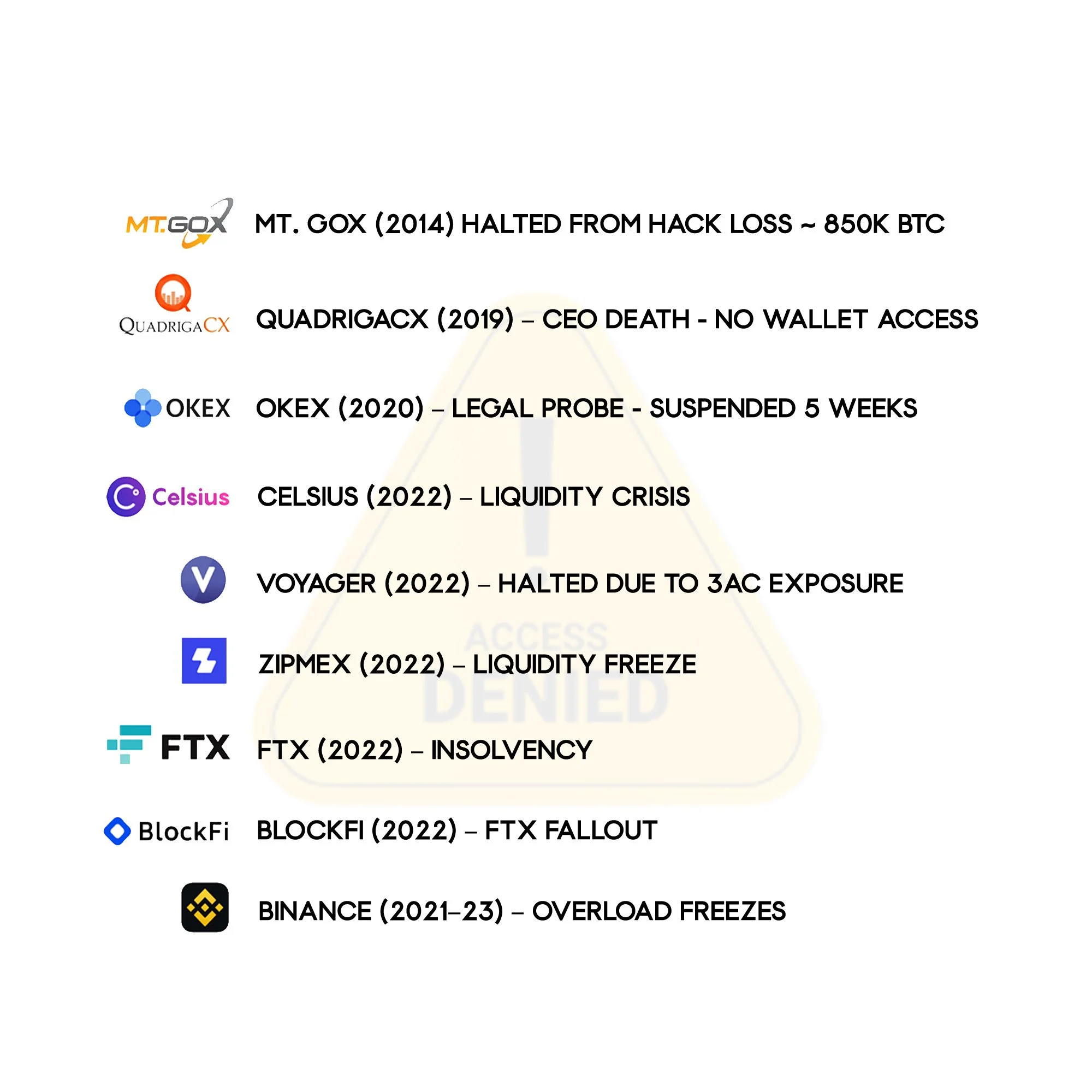

One of the biggest risks with centralized exchanges is that they can suddenly halt withdrawals, leaving you unable to access your funds when you need them most. Whether it’s due to hacks, legal investigations, insolvency, or liquidity crises, countless exchanges like Mt. Gox, QuadrigaCX, OKEx, Celsius, Voyager, FTX, and BlockFi have frozen user withdrawals with little to no notice. Even top platforms like Binance have paused withdrawals temporarily during traffic surges and system upgrades. When your assets are on an exchange, you rely on their operations to stay online and solvent. Cold wallets remove this risk entirely by keeping your crypto in your own hands, offline, and accessible anytime you choose.

#4: OVERLOADED WEBSITE TRAFFIC

Locked Out During Critical Moments

During times of market panic or rapid price surges, centralized exchanges often become overwhelmed by heavy user traffic, causing websites and apps to crash or freeze. Platforms like Coinbase, Binance, Kraken, and Robinhood have all experienced outages that left users unable to log in, trade, or withdraw funds precisely when they needed access the most. These technical failures happen because exchanges operate online and rely on server infrastructure that can only handle so much demand at once. Cold wallets eliminate this vulnerability, ensuring you always have full access to your assets, regardless of market chaos or website failures.

#5: CHANGING LEGISLATION

Forced Out Overnight

Crypto regulations are changing rapidly, and new laws can force exchanges to restrict services or leave a country entirely with little warning. Platforms like Binance, Bitfinex, and Poloniex have exited or limited U.S. operations due to evolving compliance requirements, while others like Deribit and Bybit geo-blocked American users altogether. If an exchange is suddenly banned or regulated out of your country, you could lose access to your account or face urgent withdrawal deadlines. Cold wallets protect you from these legal uncertainties, keeping your assets in your own hands no matter what rules change or which exchanges leave your region.